If you have bad credit or no credit, secured credit cards can help. Here’s how you can start driving up that credit score.

Those with low credit scores often find themselves in a catch-22. To get a loan, you need a good credit score. But to get a good credit score, you need to show a history of responsible borrowing.

That’s where secured credit cards can help. Secured credit cards provide those with bad credit or no credit access to a credit card. That’s what they’re designed for. And with responsible use plus a little time, they can increase your credit score. But we’ll get back to that. Let’s start with how secured credit cards work.

OpenSky® Secured Visa® Credit Card

- No credit check to apply and find out instantly if you are approved.

- OpenSky gives everyone an opportunity to improve their credit with an 85% average approval rate for the past 5 years

- Get considered for a credit line increase after 6 months, with no additional deposit required

- You could be eligible for the OpenSky Gold Unsecured Card after as few as 6 months

- Reports to all 3 major credit bureaus monthly, unlike a prepaid or debit card

- Nearly half of OpenSky cardholders who make on-time payments improve their FICO score 30+ points in the first 3 months

- Your refundable* deposit, as low as $200, becomes your OpenSky Visa credit limit

- Easy application, apply in less than 5 minutes right from your mobile device

- Offer flexible payment due dates which allow you to choose any available due date that fits your payment schedule

*View the cardholder agreement

Annual Fee $35

APR17.39%

Limits $200- $3000

First Progress Platinum Prestige Mastercard® Secured Credit Card

- Receive Your Card More Quickly with New Expedited Processing Option

- No Credit History or Minimum Credit Score Required for Approval

- Quick and Complete Online Application; No credit inquiry required!

- Includes Free Real-Time Access to Your Credit Score and Ongoing Credit Monitoring powered by Experian

- Full-Feature Platinum Mastercard® Secured Credit Card; Try our new Mobile App for Android users!

- Good for Car Rental, Hotels; Anywhere Credit Cards Are Accepted!

- Monthly Reporting to all 3 Major Credit Bureaus to Establish Credit History

- Credit Line Secured by Your Fully-Refundable Deposit of $200 — $2,000 Submitted with Application

- Just Pay Off Your Balance and Receive Your Deposit Back at Any Time

- 24/7 Online Access to Your Account

- Nationwide program; available in all 50 US states *See Card Terms.

- Get a fresh start! A discharged bankruptcy still in your credit bureau file will not cause you to be declined.

- ¡Hablamos Español! Nuestros representantes de servicio al cliente hablan Español con fluidez para su conveniences.

- Make 6-months of on-time payments & you’ll be invited to apply for an unsecured First Digital Mastercard!

Annual Fee $49

APR12.99%

Limits $200- $2000

Applied Bank® Secured Visa® Gold Preferred® Credit Card

- Better than Prepaid…Go with a Secured Card! Load One Time – Keep On Using

- Absolutely No Credit Check or Minimum Credit Score Required

- Automatic Reporting to All Three National Credit Bureaus

- 9.99% Low Fixed APR – Your Rate Won’t Go Up Even if You Are Late

- Activate Today with a $200 Minimum Deposit – Maximum $1,000.

- Increase Your Credit Limit up to $5,000 by Adding Additional Deposits Anytime

Annual Fee $48

APR9.99%

Limits $200- $5000

How Secured Credit Cards Work

For the most part, secured credit cards work just like regular credit cards. They carry the Visa, Mastercard, or Discover brands. So, they’re accepted anywhere unsecured cards are. You can use them in stores or online for purchases up to your available credit line. And they don’t say “secured” on the credit card. They look just like a regular credit card.

Security Deposit

There’s one main difference though. A secured credit card requires a security deposit. It’s like an apartment security deposit. It guarantees that you’ll meet your obligations to pay the balance of the card. In that way, the deposit substitutes for a good credit score by reducing the card issuer’s risk that you won’t pay.

Also like an apartment security deposit, a secured credit card deposit is refundable. The card provider returns it when you close your account as long as you’ve paid off the balance.

Interest and Fees for Secured Credit Cards

Interest rates and annual fees vary across credit cards–both secured and unsecured. About half of unsecured credit cards charge an annual fee, according to ValuePenguin. Most (but not all) secured cards charge one.

Annual fees for secured credit cards generally range from $0 to $50–lower than many unsecured cards. However, very few secured credit cards offer travel or cash back rewards like unsecured cards with higher annual fees frequently provide.

Rates on secured cards won’t be as low as unsecured cards for excellent credit. But they’re almost always lower than unsecured credit cards for bad credit. With both, interest can get expensive. As of early this year, the average credit card annual percentage rate was 17.52%.

The good news is that many secured credit cards offer a grace period before interest accrues. So you can avoid interest charges altogether if you pay the entire balance by your statement due date. That’s why it’s best to pay off the balance each month.

Cash Advances on Secured Credit Cards

Just like other credit cards, secured credit cards allow you to get a cash advance from your card.

But just like other credit cards, the interest rate for cash advances is (almost) always higher than for purchases. And there’s no grace period on interest. The interest starts as soon as you get the cash.

Avoid them like the plague.

Secured Credit Card Limits

Credit limits for secured credit cards are usually equal to your deposit. If you pay a security deposit of $500, you’ll receive a $500 credit limit. The minimum limit for a secured credit card is usually $200 – $300. The maximum varies by card but typically caps at $5,000.

Steps to Improve Your Credit with Secured Credit Cards

Secured credit cards can improve your credit score, but just getting one won’t.

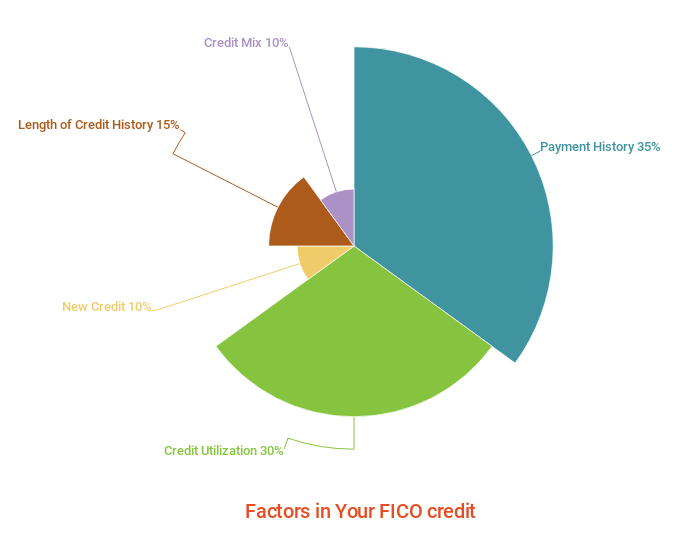

According to Fair Isaac (creators of the FICO score), the two largest factors that determine your FICO score are payment history and credit utilization. Payment history reflects your on-time payments for revolving loans (mainly, credit cards) and installment loans (like a mortgage or car loan). Credit utilization means the amount of credit you use versus the amount you have available. Together, they make up 65% of your score.

The purpose of a secured card is to improve those two big factors that drive your credit score–on-time payments and credit utilization.

Keep Your Balance Low

Once you get a secured credit card, use it. But use it sparingly.

Make one or two smaller purchases each month. Stick with things you currently buy with cash–like gas or convenience store purchases. Using only a small amount of your available credit will increase your score. But using a high percentage can have the opposite effect. According to Fair Isaac, the upper end of that threshold is 30%. The lower, the better.

Also, keep in mind that credit cards report to the major credit reporting agencies once a month. So even if you pay off your card at the end of the month, the balance reported by card issuers will be the balance on the day they report. That’s why you should keep the card balance less than 30% throughout the month.

Pay On Time

This is critical. A single late payment on any credit card will hurt your score and will be on your credit report for seven years.

To ensure that you pay on time, consider setting up automatic payments with your card. Nearly all credit cards will allow you to set an option to automatically pay the minimum payment or the entire balance from your checking account.

Look for Other Ways to Improve Your Score

Secured cards can help improve your credit score, but they’re not the only way.

Fix Credit Report Errors

According to the Federal Trade Commission, 5% of consumers have errors on their report. Fixing those can immediately increase your score.

Start with your credit report. You can get your score, along with items affecting items impacting your credit through Credit Sesame. It’s free and a great way to track your progress.

Alternatively, you can get your full credit report once per year at no cost from each of the major credit bureaus at AnnualCreditReport.com.

If you find errors, dispute them. The FTC offers a step-by-step guide to help.

Resolve Any Delinquencies

If you have other credit cards or loan accounts with delinquent balances, you’ll still need to resolve those. Timely payments on a new card will have little effect if other loans have unresolved delinquencies.

Use the Right Tool for the Job

Secured credit cards can be a great tool to increase a low credit score. But they’re not likely to be your primary spending card. Keeping credit utilization low means that you’ll want to keep spending limited.

If you’re looking for a card for general spending, consider a checking account debit card or a low-cost prepaid debit card. They carry Visa or Mastercard brands and are accepted nearly anywhere credit cards are. With debit cards, you’re spending your own money so they won’t impact your credit score–good or bad.