The Consumer Finance Protection Bureau released proposed disclosure guidelines for prepaid cards. Back in March the CFPB asked for comments on proposed disclosures. At the time, the agency noted that currently “each prepaid card company’s retail package discloses different information, which makes it difficult to do side-by-side comparisons.”

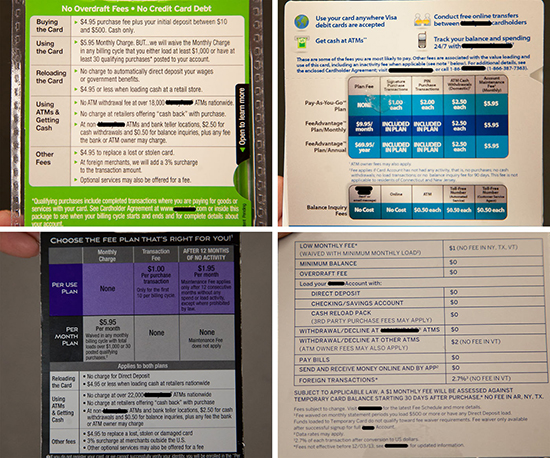

It’s a challenge we faced as we built our comparison engine here at Prepaid Cards 123. It’s incredibly difficult to compare cards both because of the many variances in fees and the different ways consumers can use the card. From the CFPB website, for example, here are current disclosures from four prepaid cards:

We are all too familiar with these cards. Although the CFPB redacted the names of the cards, these disclosures come from Green Dot Prepaid Visa®, Netspend® Visa® Prepaid Card, and American Express Serve®.

With respect to reloadable prepaid cards, the CFPB has proposed disclosures for cards with overdraft protection:

And for cards without overdraft protection:

We like these disclosures for the most part. In fact, they look a lot like the information we provide here (although we provide a lot more detail). The CFPB is looking for comments on the disclosures, specifically–

- Does the short form disclosure above make it clear how much the account would cost you to use?

- What would you like to see added or changed? Is there some way to make the information clearer?

- Is there anything you find confusing?

Let us know what you think of these disclosures in the comments below.